Jima Gene focuses on RNA research and development and enters the direction of precision medical big data

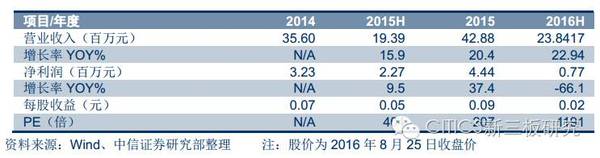

The performance fell by 66.1% year-on-year. In the first half of 2016, the company realized revenue of 23.84 million yuan, a year-on-year increase of 22.94%; net profit of returning to mothers was 770,000 yuan, down 66.1% year-on-year, and EPS was calculated to be 0.02 yuan with 11.924 million shares. The company's gross profit margin for the first half of 2016 was 58.4%, down about 1pcts from 59.2% in the same period of last year; the net profit margin was 2.3%, which was about 14.4pcts lower than 16.7% in the first half of 2015. The current government subsidy was reduced from 2.02 million yuan to 810,000 yuan, resulting in a 66.1% decline in net profit. After deducting non-recurring gains and losses, the net profit was RMB 125,300, which was an increase from the previous period of RMB 0.38 million. The actual operating conditions have improved.

High R&D investment results are remarkable, and cost growth does not affect the company's operating conditions. In the first half of 2016, the company developed a new optimization method based on CRISPR/Cpf1 gene editing technology and applied for one invention patent. In the field of precision medicine , the company developed an instrument for separating tumor circulating cell CTC from blood and obtained approval. The certificate will be applied to the early stage of tumor screening, postoperative medication guidance for cancer patients and other fields. The current research and development expenses were 5.83 million yuan, accounting for 24.5% of the revenue, up 15.8% year-on-year. At the same time, the company's operation scale has expanded slightly. In the first half of 2016, the total number of employees was 226, a year-on-year increase of 3.2%. In the first half of the year, the company's management and sales expenses were 1126 and 2.5 million yuan respectively, up 15% and 40% respectively. Overall, the ratio of cost to revenue growth is basically the same. We expect the company's full-year gross profit margin and net profit margin to remain at 56%-61% and 2%-4%.

R&D cooperation drives the company's transformation into small nucleic acid innovative drugs and genetic diagnostics. In the first half of 2016, the company transformed its technology services for medical institutions to produce and sell self-developed small nucleic acid innovative drugs and genetic diagnostic reagents. The contribution of small nucleic acids and related gene products has accounted for more than 80% of total income. In April 2016, the company signed a cooperation agreement with the Shenzhen Graduate School of Tsinghua University. In June of the same year, the company reached a cooperation intention with the University of Suzhou Genomics Resource Center. The company actively promotes school-enterprise cooperation, accelerates product research and development, builds channels for long-term promotion of products, and maintains stable growth in performance. Now the company's business has begun to take shape, the production process has been improved, and the sales channels have been fully opened. We expect the company's revenue from small nucleic acids and related gene products to continue to grow by 25%-30% in the second half of the year.

Extend the extension of the industrial chain and build a big data platform for genetic testing. In February 2016, the company invested 1 million yuan to establish a shareholding company, Beijing Zhongkejiyin Technology Co., Ltd., holding 20% ​​of the shares. The investment is intended to leverage the company's leading computing power in the Chinese Academy of Sciences, combined with the company's existing genetic testing technology platform, to help companies build technological advantages and cost advantages in genetic testing back-end data processing and storage. We expect the company to actively promote the goal of optimizing the existing business to cover the entire industry chain upstream and downstream in the second half of the year and strengthen its competitive advantage.

Risk factors. The risk of company scale expansion and the risks brought about by the development of new medical devices and new drugs.

Investment Advice. As a service provider in the upstream and downstream of the molecular diagnostics industry, the Gemma gene is expected to perform in the research and development of small nucleic acid new drugs based on RNA interference technology. The company's current stock price of 19.38 yuan and the market value of 231 million yuan correspond to 1191X PE in the first half of 2016. It is recommended to pay attention.

JIANGSU CLS TECHNOLOGY CORP.LTD , https://www.js-cls.com